Introduction

Within the next month, validators on Ethereum can start unstaking their ETH and receive the amount they staked and the rewards they’ve earned. Despite misconceptions, this ETH will not all be unlocked at once, as a security precaution. Today’s write-up explains how unstaking on Ethereum will work. Enjoy.

Sections

What is a Hard Fork?

Why Does Unstaking Have Queues?

How Will Unstaking on Ethereum Work?

What Will the Impacts of Unstaking Be?

In Conclusion

*Thank you to Ziad for proofreading.

Hard Forks

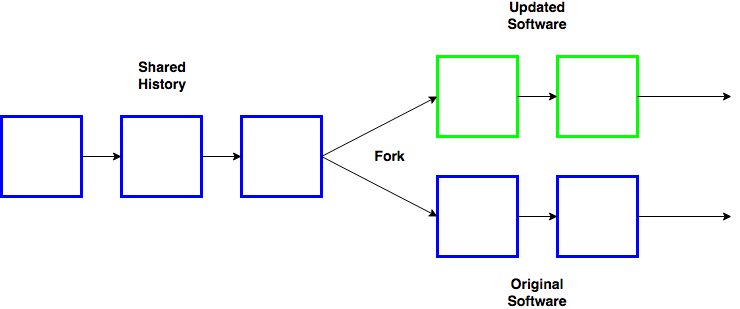

The ability to unstake ETH comes with the Shanghai hard fork this month, so let’s first review what forks are. A hard fork is how a public blockchain upgrades itself and adds new functionality to the core protocol. They’re called forks because requiring new rules creates a new blockchain sprouted from the original, kind of like a fork in the road.

At this figurative fork in the road are validators. They must decide whether to follow the old rules - and not accept the changes, or update their machines to be ready for the new rules once they’re live. For a hard fork to be successful, most or all validators should be ready to switch to the newly forked blockchain at an agreed time (defined as a block number).

The Need for Queues

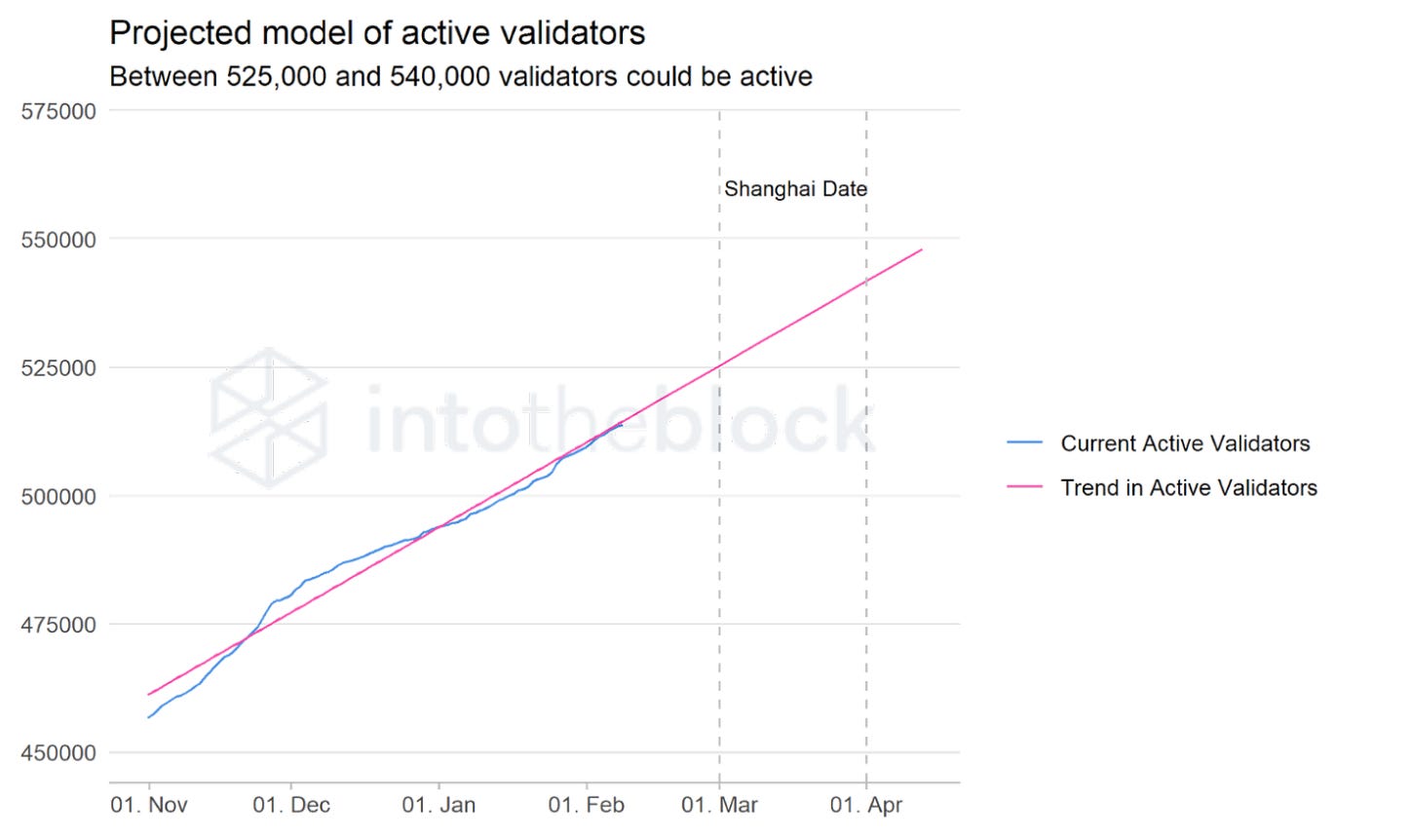

Today there are just over half a million Ethereum validators around the world, collectively staking 17.2 million ETH (about 14% of the total supply). To keep this validator set healthy, it should be protected from any drastic changes in number for security. If the number of validators could increase or decrease very quickly, this could be employed as a tactic in orchestrating an attack.

A party could potentially exit a large number of validators, immediately causing a scare and others to exit, then instantly activate twice the amount of validators and gain significant control over the network. If there were no buffers to exit and entry, this could be a serious vulnerability to Ethereum. Beyond the queues, there are additional penalties to those that perform a malicious action (like proposing two different blocks at once) and are slashed.

Unstaking on Ethereum

The Shanghai hard fork introduces withdrawals for which information is written into a new space on Ethereum blocks, without the need to pay for gas. There are two queues withdrawers must go through to withdraw their ETH. The first is the exit queue and is somewhat slow, the other is the withdrawal queue and is much faster.

The slower exit queue is only necessary to enter if a validator is trying to withdraw all of their staked ETH (the principal + rewards), in which case it’s called a full withdrawal. The exit queue allows 7-8 full withdrawals to happen every 32 blocks. The number of withdrawals permitted in such a period is called the “churn limit,” and increases as more validators become active. Once a validator intending a full withdrawal goes through this exit queue, they’ll arrive in the withdrawal queue. It would take 100,000 validators (approximately 1/5th of the current set) 63 days to go through the exit queue.

The faster withdrawal queue processes a maximum of 16 full or partial withdrawals every block (or every 12 seconds). A partial withdrawal happens automatically and disburses rewards earned by validators to addresses they designate to receive those rewards. Both partial and full withdrawals are viewed as equal in the withdrawal queue. It would take 100,000 validators 20 hours to go through the withdrawal queue.

There is a prerequisite to entering either of the queues above: validators must ensure that withdrawal addresses are updated and refer to valid addresses on Ethereum (technically, in the 0x01 format). This can be done now, and doing so will place rewards for those validators in the withdawal queue automatically once Shanghai goes live.

Impacts of Unstaking

While likely that many will want to unstake their ETH initially, the capacity for validators to withdraw is throttled. The reason is so that the validator set doesn’t change too drastically in too short a time. For the same reason, a queue exists to begin staking ETH. This also impacts the price of ETH, which won’t see the supply dump many prophesize.

It is likely that even amongst those who unstake, a significant portion will start staking again shortly thereafter. This is because many will be shifting from one staking service to another, something they can’t do until they unstake first. A further incentive is in the rewards rate, which increases as the validator set gets smaller.

Finally, the automatic disbursement of rewards will be exciting to look forward to. It introduces new liquidity into the Ethereum ecosystem directly, as opposed to having it locked up with the ETH that’s being staked. Ever since the Merge happened, validators have not received their rewards for validating the blockchain, the rewards are locked with the staked ETH. The additional ~0.2 ETH per block added directly into the ecosystem should have some interesting effects.

In Conclusion

It’s fascinating that staking withdrawals are right around the corner. The conversation around whether to include withdrawals in the Shanghai hard fork was a big reason this newsletter started. It seemed necessary that as many of us in Ethereum as possible be knowledgeable about upcoming upgrades so that we can lend our support to the ones we consider most important.

Staking withdrawals will legitimize Ethereum in the eyes of many bystanders, waiting on the sidelines to see if this final piece of the puzzle will fit. People can soon rest assured that they’ll receive a sustainable return on their investment, one that comes from securing the Ethereum network. It’ll be exciting to watch the effects, both short-term and long.

Thank You & Additional Reading!

Thanks a lot for reading! Here are some more resources if you'd like to dive deeper.

Please like this post and sign up for more simple write-ups on blockchain concepts.

If you’d like me to cover any topics or have any questions, reach out in the comments!

Stay kind. Stay curious.